BALTIMORE, MD—In collaboration with Maryland’s financial institutions, Governor Larry Hogan on Friday issued an Executive Order and announced a series of financial relief initiatives to provide assistance to millions of consumers and small businesses who are facing economic hardships due to COVID-19.

“As our state responds to this deadly public health emergency, Marylanders should not be worried about losing their homes, cars, or property. Instead, they should be worried about keeping themselves and their family safe and healthy,” said Governor Hogan. “These financial initiatives will provide much needed relief to millions of hardworking consumers and business owners in Maryland who are now facing financial difficulties through no fault of their own.”

Several of Maryland’s largest banks, credit unions, mortgage lenders, state agencies, and other financial entities have collaborated to provide additional flexibility to consumer borrowers and lessen the economic impact of COVID-19.

“We are so grateful to our state’s financial providers for rallying together and providing immediate financial relief and peace of mind to Marylanders during the COVID-19 pandemic,” said Maryland Department of Labor Secretary Tiffany P. Robinson. “I encourage all Marylanders to contact our department’s Office of the Commissioner of Financial Regulation for additional financial resources and guidance. Labor is here to help, and we will get through these difficult times together.”

“I appreciate the Governor taking these swift and direct actions,” said Maryland Commissioner of Financial Regulation Antonio P. “Tony” Salazar. “They will enhance my Office’s ability to carry out its consumer protection mandates so that we can ensure that Marylanders keep their autos and homes during this crisis. We also look forward to collaborating with Maryland’s banks, credit unions, mortgage and consumer lenders as they continue to support Maryland’s residents and small businesses.”

Consistent with applicable guidelines, Marylanders may be eligible for the following relief upon contacting their financial service providers.

MORTGAGE RELIEF

90 Days of Payment Deferrals

Mortgage lenders and servicers will provide payment deferrals of up to 90 days for mortgage payments.

Late Fee Waivers

Mortgage lenders and servicers will not charge late fees for specified periods.

Credit Reporting

Mortgage lenders and servicers will not report negative information to the credit bureaus relating to payment deferrals consistent with the CARES Act.

Moratorium on Residential Foreclosure Initiation

While the Maryland Courts have temporarily stayed pending foreclosure filings, the Governor’s Executive Order goes further and temporarily prohibits residential mortgage holders from initiating residential mortgage foreclosures. Governor Hogan urges all mortgage lenders and servicers to immediately implement the forbearance and reduced payment programs established by the federal authorities.

ADDITIONAL CONSUMER RELIEF

Residential Eviction Moratorium

Temporarily prohibits evictions of tenants suffering substantial loss of income due to COVID-19.

Vehicle Repossession Moratorium

Temporarily prohibits vehicle repossessions and other creditor “self-help” remedies to ensure those in need of mobility can continue to access jobs and medical assistance during the COVID-19 emergency.

Mobile Home Repossession Moratorium

Temporarily prohibits the repossession and/or foreclosure upon mobile homes and other non-permanent dwellings.

General Consumer Loan Relief

Two of the largest consumer lenders, OneMain Financial Group, LLC and Mariner Finance, LLC have committed that they will provide assistance to consumer borrowers impacted by the crisis by offering assistance programs such as general deferral loan programs and temporary or permanent modification options to those impacted, including providing certain late fee waivers, and temporarily refraining from reporting negative information to the credit bureaus relating to payment deferrals. To take advantage of the companies’ programs, borrowers should contact them and ask about specific relief programs.

Suspend Repossession Cases

Along with these actions, Governor Hogan calls upon the Court of Appeals to stay (suspend) all pending auto and mobile home, motor coach, etc., repossession cases to the same extent that was done with mortgage foreclosures and evictions.

BUSINESS RELIEF

Governor Hogan’s Executive Order also contains a number of provisions that will prove beneficial to Maryland’s banks, credit unions, and small and medium sized businesses during the COVID-19 outbreak.

Commercial Eviction Moratorium

Temporarily prohibits evictions of small and medium sized business tenants suffering substantial loss of income due to COVID-19.

Permission to Suspend Certain Bank and Credit Union Lending Limits

To give lenders flexibility in structuring loan modification plans, the Order grants authority to the Commissioner of Financial Regulation to suspend the application of the State’s legal lending limits to allow such State-chartered banks and credit unions to engage in a transaction or series of transactions that would normally exceed the legal limits, if the Commissioner finds that doing so would not reasonably be expected to impair the safety or soundness of the State-chartered commercial bank.

Governor Hogan is also making the following requests of businesses and lenders:

Help Small Business Tenants

Commercial landlords are urged to provide rental relief for small business tenants. Maryland lenders are urged to waive any restrictions on commercial landlords in loan documents so as to allow the landlords to provide rental relief to their small business tenants.

Prevent Unwarranted Credit Card Chargebacks

Credit card companies and credit card processing companies are urged to carefully review credit card chargebacks so as not to wrongfully charge small businesses.

Join the Paycheck Protection Program

All Maryland banks and credit unions are urged to join the Small Business Administration’s Paycheck Protection Program in order to assist in the prompt distribution of federal CARES Act funds to small businesses.

Conserve Capital

Maryland chartered banks are urged to suspend any pending stock-buyback programs and carefully review future dividend payment plans so as to conserve capital so it can be used to help their Maryland business customers.

RELIEF FROM STATE AGENCIES

Suspension of State Debt Collection

In order to lessen the burden on Maryland’s citizens and businesses during this time of crisis, Governor Hogan is also announcing that all State executive agencies will suspend debt collection activities until further notice.

All Marylanders, consumers and businesses, are urged to contact their financial service providers as soon as they believe they will have problems making payments to learn about additional opportunities for assistance during COVID-19. For more information about the financial resources available in Maryland, visit the Office of the Commissioner of Financial Regulation’s website.

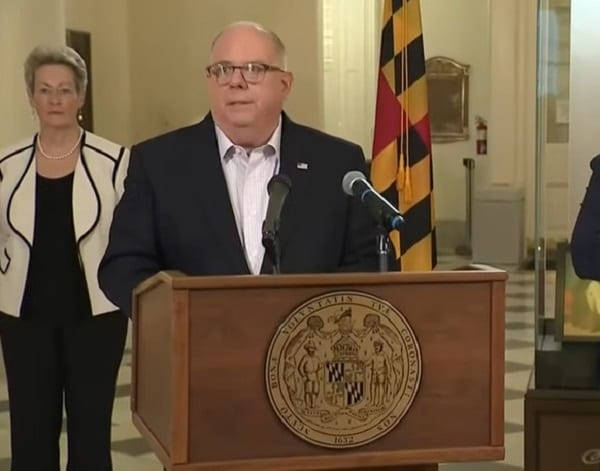

Governor Hogan’s full Friday press conference can be viewed below.

Do you value local journalism? Support NottinghamMD.com today.